New York’s Paid Family Leave will be financed by employees through payroll deductions. And the draft regulations state that employers can start collecting these contributions as early as July 1, 2017.

The sole purpose of this guide is to help you prepare for the January 1,

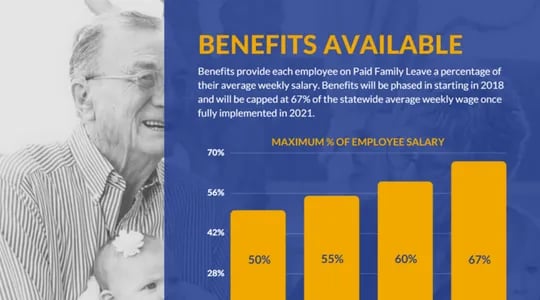

Paid Family Leave in New York will begin its 4-year gradual phase-in on January 1, 2018. Our Guide explains how the law works and what the increases in time off and benefits eligibility will be each year. We'll also explain what's eligible (hint: it's not just maternity leave) and what the exceptions are. It may seem complicated now, but its bark is much bigger than its bite. After reading our Guide you're going to know this like the back of your hand.

Cathie Rene, Human Resource Coordinator at Rochester Hearing and Speech

Arden Neubauer, Business Manager at Hunt Hollow Ski Club

Teresa Jackson, President at Dudley Poultry