Understanding Box 14 on the W-2

Overview

Most boxes on the W-2 are pretty self explanatory. Everything has a specific box that it belongs to. However, there are times when you want to communicate amounts to your employees through their W-2s but the information really doesn’t fit any of the other box requirements. This is where Box 14 of the W-2 comes into play.

Let Ashley Hamilton, our Tax Manager, explain...

Making sense of Box 14

Employers use Box 14 on Form W-2 to provide other information to employees. Generally, the amount in Box 14 is for informational purposes only. However, some employers use Box 14 to report amounts that should be entered on your employee's personal tax returns.

Some examples of items reported here could be:

- the lease value of a vehicle provided to an employee

- union dues

- state disability insurance taxes withheld

- uniform payments

- health insurance premiums deducted

- non-elective employer contributions made on behalf of an employee

- required employee contributions

- employer matching contributions

- voluntary after-tax contributions made to deferred compensations

- educational assistance payments

- money donated to charities

- S-corp health

- RRTA (railroad)

- pre-tax employer contributions to a cafeteria plan

- after-tax HSA

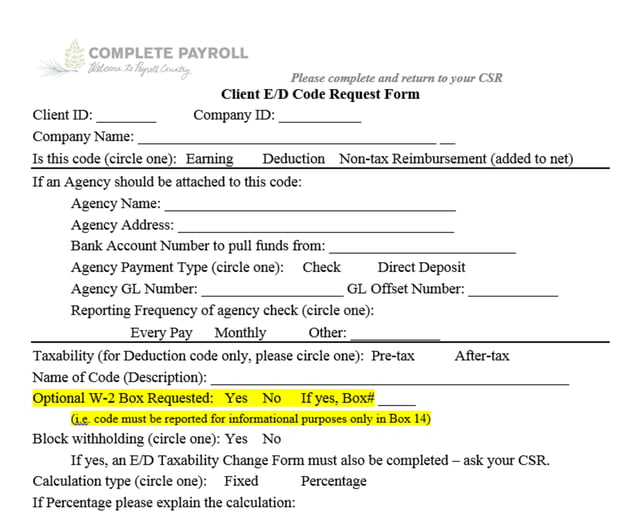

If there is information that you would like to communicate to your employees through box 14 Just let us know or when requesting a code for any of these items there is an option on our form to request a special W-2 Box. Just enter Box 14 on that line and it will appear on your W-2 come year end.

Want to get in touch with our tax department?

Complete the form below to get in touch with Ashley, or someone else from our tax department.